End of an era: Absa to scrap cheques - starting next month

- Staff Writer: Helena Wasserman

Absa will stop issuing new cheques from the start of July, a death knell to the once-popular payment form.

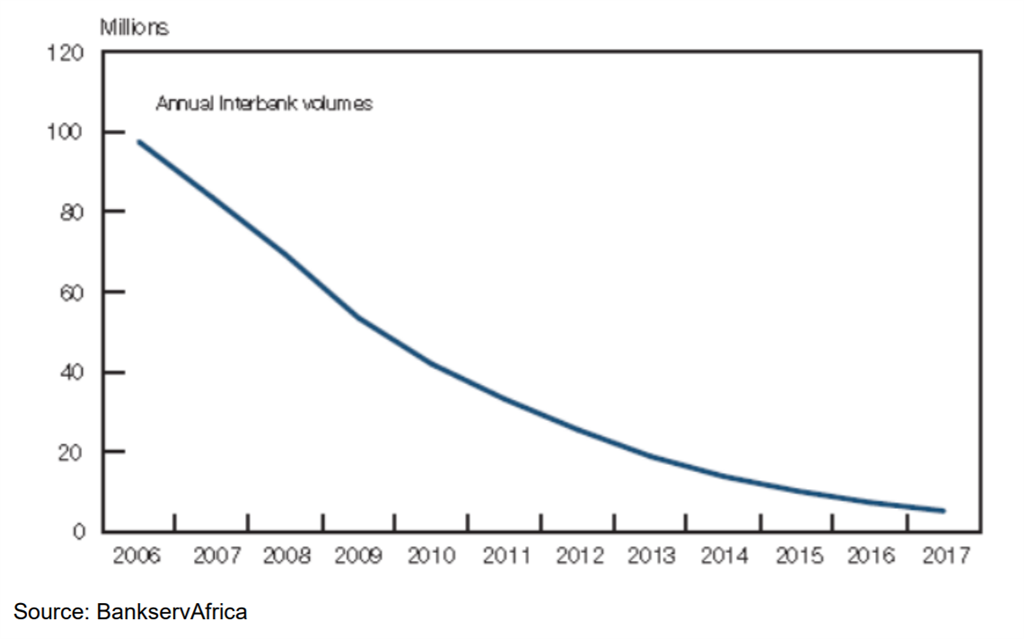

Cheque volumes in South Africa have fallen to 80% compared to ten years ago, making cheques uneconomical and commercially unviable, says Bongiwe Gangeni, Absa’s deputy chief executive of retail and business banking at Absa. Cheques have been crowded out by electronic transactions and banking cards.

Last month, SA’s banking authorities slashed the maximum legal value for which a cheque may be issued in South Africa from R500,000 to R50,000.

This was due to security concerns, including problems with forged, altered and counterfeit cheques. In a report, the Reserve Bank also noted the emergence of “cheque washing” - criminals are using chemicals to erase the information on a cheque to replace it with false details.

“Against this background, Absa has taken a business decision to exit cheques as a payment instrument from its product functionality, by December 2020,” says Gangeni. “To ensure minimum disruption to customers, a phased approach will be followed and from 1 July new cheque books will no longer be issued to Absa customers.”

In a letter to clients, Absa also confirmed that no bank cheques will be available from 1 July.

And from next month, customers will no longer be able to request clearance of cheques, and they will no longer receive a copy of their cheques with their statements.

“We realise that this may impact the longstanding banking experience of some of our customers – we have alternative digital payment instruments such as Online Banking, cards payments and electronic fund transfers (EFTs) capabilities available. These options are safer, convenient, and more efficient than cheques, says Gangeni.

Absa frontrunner Volkskas has been issuing cheques since 1941.

Absa will continue to honour all third-party cheques deposited, for as long as cheques are accepted by the industry, Gangeni says.