Retailers can save up to 40% by automating cash handling

Manual cash handling costs can rapidly add up, not to mention the time cashiers and supervisors spend counting, doing reconciliations and banking deposits. A smart cash management solution can reduce the time and associated costs of managing cash in your retail business.

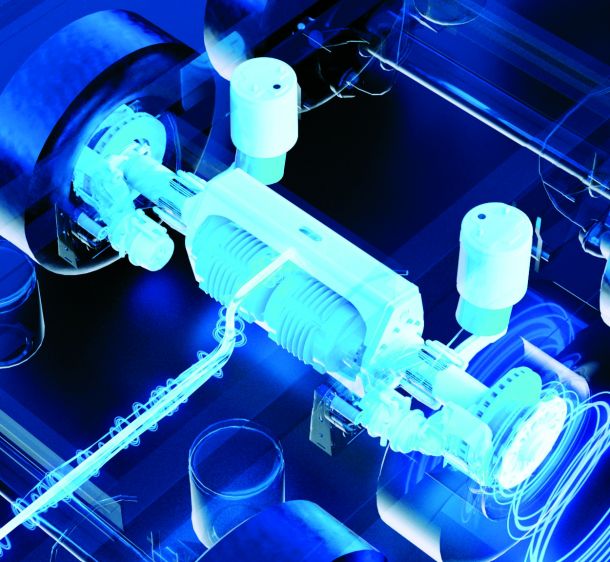

With automated cash management from Cash Connect, you can save up to 40% in time and money—and make every rand and cent in your business count. A secure cash management solution will include a robust retail cash vault, built to SABS Category 4 standards, that hardens your site substantially. Here are the benefits:

Real-time settlements. With Cash Connect you have Instant Access to your cash while it is still in the cash vault or smart retail ATM Recycler. Whether you need to make an urgent supplier payment or pay for a repair, you can access your cash from an app whenever you need it.

Immediate risk transfer. Once you deposit your cash into the cash vault, Cash Connect guarantees the funds in your bank account. Your cash risk is covered from the moment the cash is dropped into the Cash Connect cash vault, while in transit and until the funds reflect in your bank account.

We protect the cash. Our vaults can withstand tough attacks and so deflect criminal activity to softer and more vulnerable retail sites.

Pay from a SuperWallet to save money when buying stock or paying suppliers. When dropping cash in your retail cash vault, automatically top-up your SuperWallet, so that you can buy stock or pay over 450 pre-loaded suppliers without having to pay a cash deposit fee.

Access up to R5 million opportunity capital in 24 hours. As a member of the Connect Group, Cash Connect is part of a bigger fintech solution. Capital Connect, our lending division, offers unsecured short-term business funding with flexible, small daily repayments straight from the cash in your vault to manage your cash flow levels. This enables you to capitalise on retail opportunities as and when they arise.

Reduce CIT costs. If you opt for our smart ATM recycler, you can reduce Cash-in-Transit (CIT) collections and costs. Recycle cash takings by depositing them in your ATM recycler, and allow customers to withdraw cash and perform other transactions in your store. Earn rebates from each successful card withdrawal and boost your turnover.

Save time for your team. The biometric functionality enables cashiers to cash-and-dash, allowing for quick and seamless cash drops, and increasing accountability for all cash deposits.

Top-notch support. You get access to a dedicated account manager and 24/7 contact centre, manned by skilled agents, who are committed to the ongoing care and support of your business, and to help you get the most value from our solutions.

Related Articles

Southern Africa Conference 2024 - Connecting Me...

KK Shelving offers versatile shelving solutions

Transport Cooling Africa is proud to announce t...

The Good Life Show (JHB): ‘Two-for-One’ Tickets...