South Africans spent R31k per second in retail stores

A fact sheet about the retail trade industry by Stats SA showed the spending trends of South African consumers.

South Africa's retail industry can be divided into five categories: wholesale, retail, motor, food and beverages (restaurants and catering) and accommodation.

In 2017, the retail industry generated R1 trillion in sales (current prices). This means that in 2017 South Africans spent R31 900 per second in retail stores.

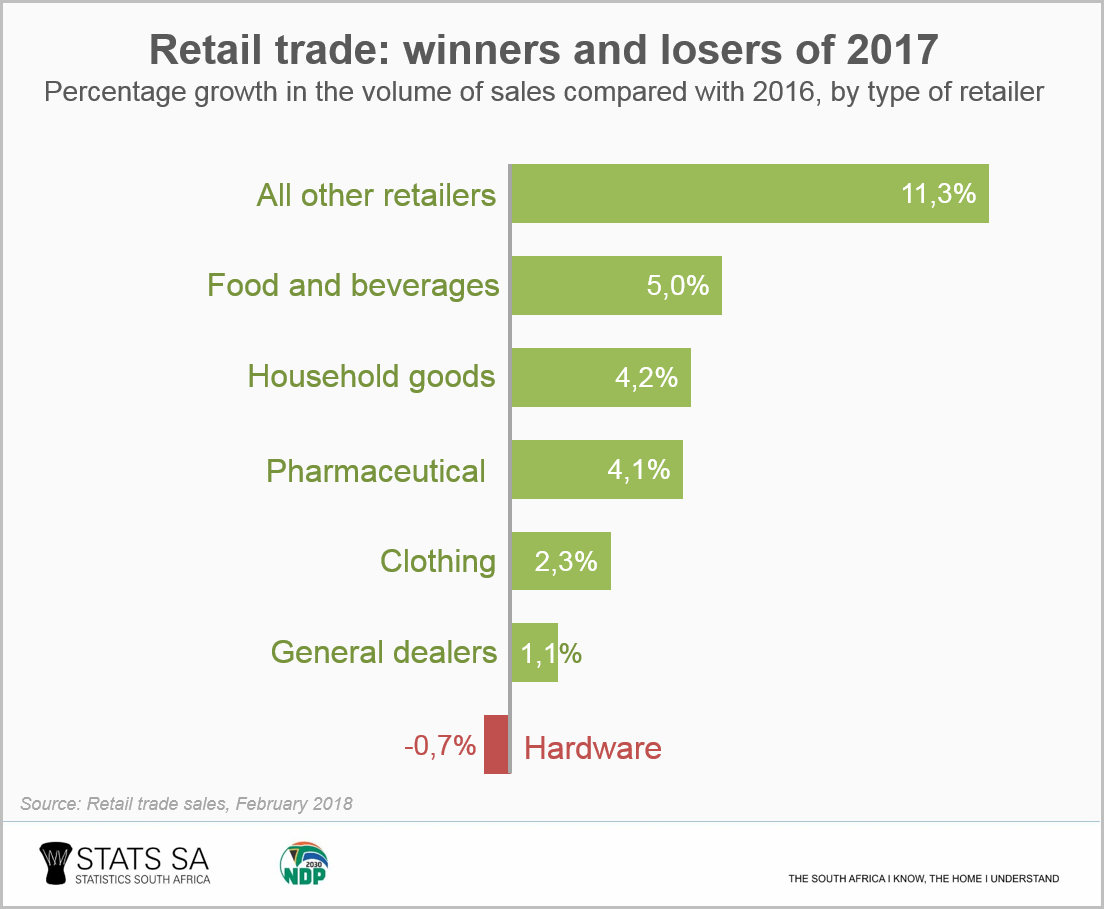

Retail spending had also increased in 2017 by 2,9% compared to 2016. Stores that specifically sold food and beverages saw their sales rise by 5% for 2017. This is the second biggest annual growth rate listed following the miscellaneous all retailers category. Sales for hardware stores dropped for 2017.

Image: Stats SA

Although general dealers had a low growth percentage of 1,1% they ruled the industry in terms of sales value. For every R100 that was spent at retail stores in 2017, R44 was spent by consumers at general dealers including supermarkets. Clothing and textile stores contributed R18 for every R100 of total sales.

Image: Stats SA

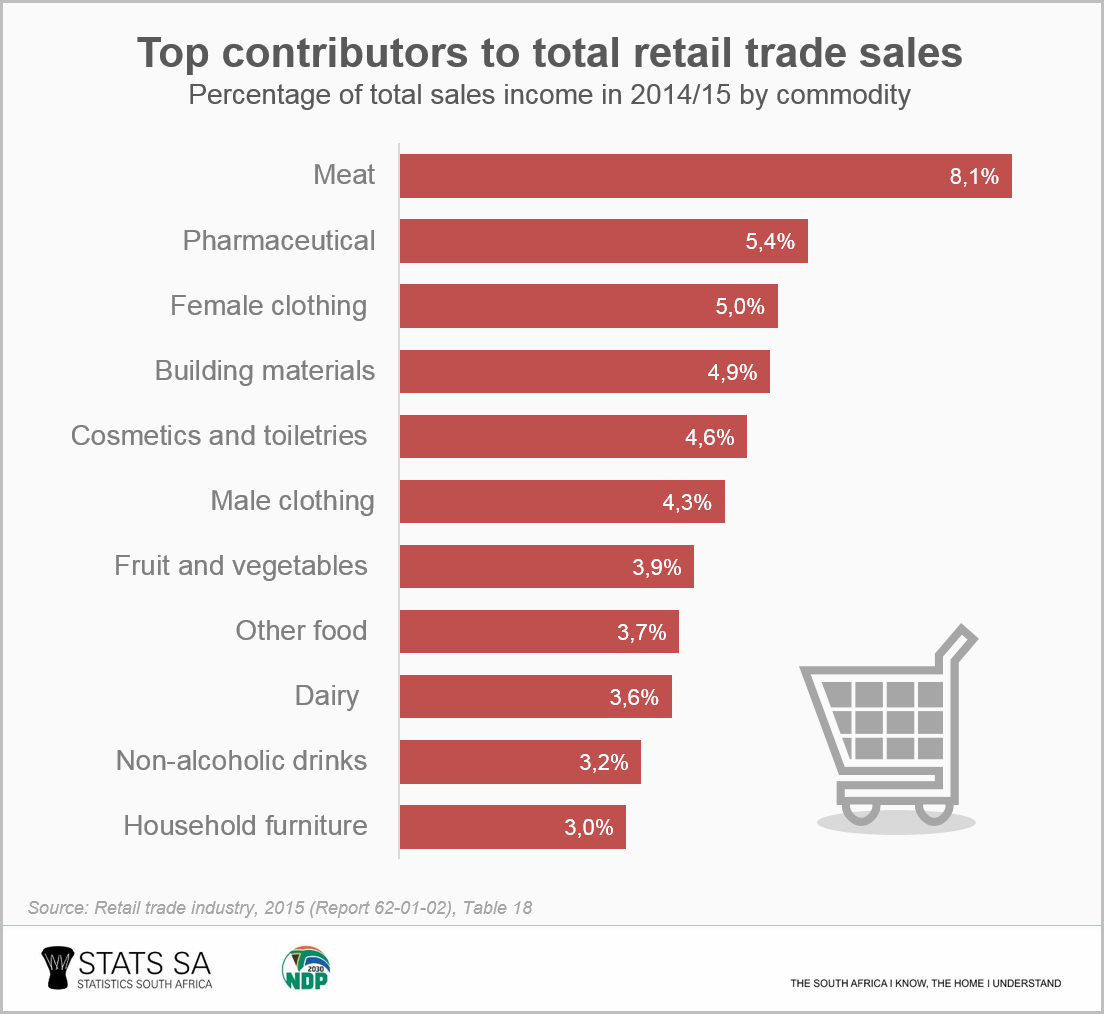

The most popular commodity in the retail industry is meat. Meat makes up 8,1% of the total sales income for 2014/2015. Pharmaceutical products were in second on the graph with 5,4% and the third most poular product was female clothing.

Image: Stats SA

The report showed that in 2014/2015 more than one-third of the 812 104 people working in the retail industry were employed in non-specialised stores. Colthing stores employ 23% of the retail workforce.

Image: Stats SA

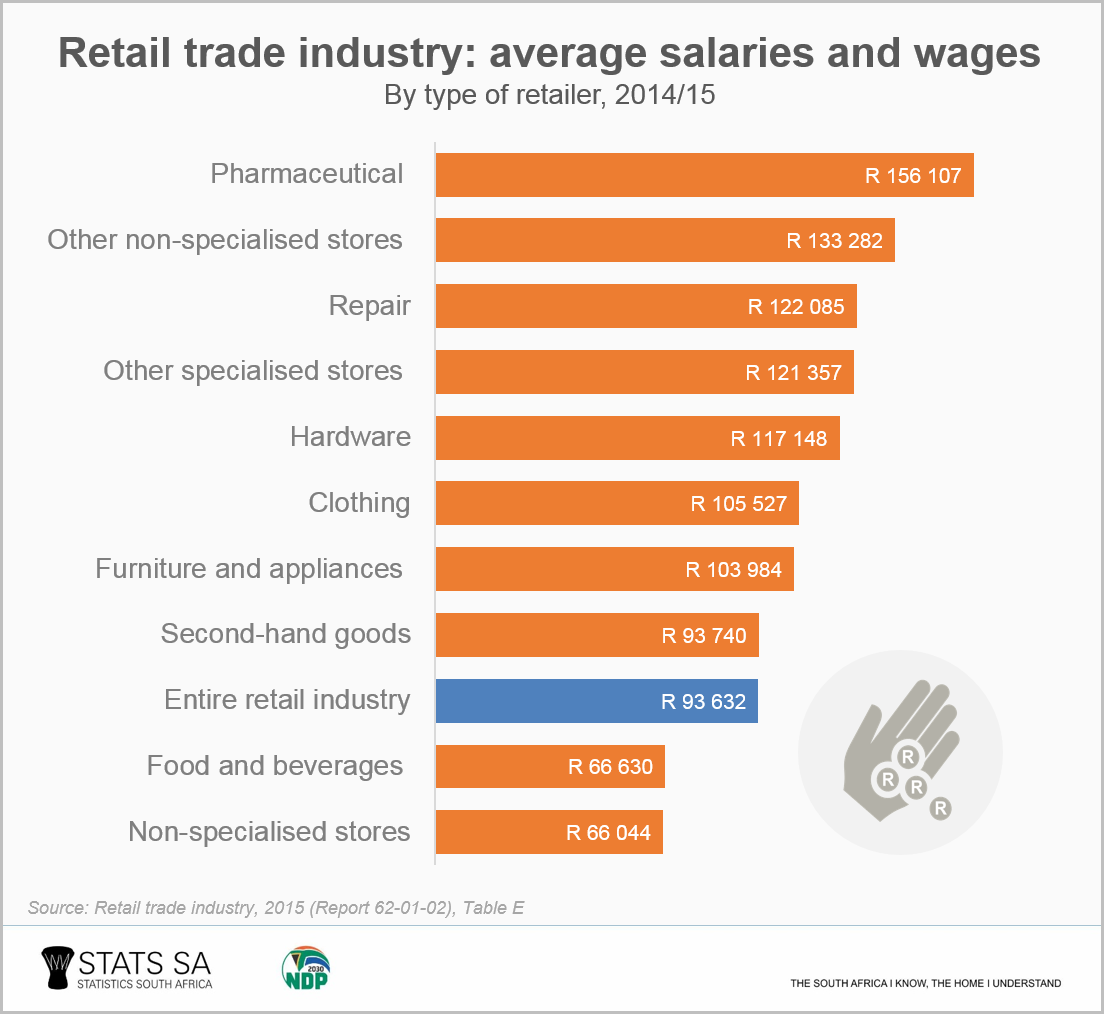

Although non-specialised store employs the most amount of people their salaries are the lowest. R66044 was the average yearly salary for a person working in a non-specialised store. That is much lower than the average salary for the whole retail industry which was R99632.

Image: Stats SA

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

Empowering South African households through gro...

South Africans are resilient people who are always ready to seek solutions for problems, even if the trials they face are caused by events that are beyond their control. An empowering example of this approach to life is the use of grocery stokvels...

SPAR shares practical tips to beat food inflation

In response to rising food costs, The SPAR Group offers practical tips for beating food inflation through savvy shopping and creative cooking.

South African motorists could be paying up to R...

By: Myles Illidge – MyBroadband

South Africa’s Road Accident Fund (RAF) tax and General Fuel Levy (GFL) add between R272 and R483 to the price of a tank of fuel, depending on the size of your car’s tank.

Big VAT changes on the cards

By: Shaun Jacobs – Daily Investor

Major changes are coming to VAT in South Africa, with the government looking to expand the range of food items exempt from the tax.

Good signs for petrol prices in South Africa

By: Hanno Labuschagne - MyBroadband

An anticipated strengthening of the rand and slipping global oil prices could result in lower petrol prices at the pumps next month.