Checkers-owner is rocking

By: Bianke Neethling - Daily Investor

Checkers-owner Shoprite is set to release stellar results for the year through June 2024, with a 12% increase in sales. This is despite a substantial diesel bill and hyperinflation in its non-South African operations.

In a trading update released on 30 July, Shoprite informed shareholders that its core business, Supermarkets RSA, achieved sales growth of 12.3% and contributed 81.0% to group sales.

This growth is reported against the prior year period in which sales increased by 17.8%.

Like-for-like sales growth for the period measured 6.3%, noting that the stores acquired from Massmart – 51 Shoprite, one Usave and 40 Shoprite LiquorShop stores – were included in like-for-like sales growth only for the second half period.

The retailer’s internal selling price inflation averaged 5.8% for the period, ending the year at 3.0% for June 2024.

Therefore, the retailer’s sales growth significantly outpaces its internal inflation.

Checkers and Checkers Hyper reported sales growth of 12.3%, with online deliveries continuing to be a boon for the retailer. Online sales from its Checkers Sixty60 on-demand platform increased by 58.1%.

Its Supermarkets RSA segment opened a net 201 stores during the year to total 2,322 stores. Of these net new openings, 20 were Shoprite, 22 Usave, 25 Checkers and 71 LiquorShop stores.

The retailer’s non-RSA supermarkets segment did not perform as well but still delivered sales growth of over 6% and contributed 8.6% to group sales.

However, Shoprite noted that this excludes hyperinflation experienced in its Ghana operations.

Shoprite increased its total merchandise sales by 12.0% to approximately R240.7 billion from continuing operations, including the impact of Ghana’s hyperinflation.

Excluding the hyperinflation, sale of merchandise increased to R240.8 billion, also up 12.0% from the prior period.

Shoprite also noted that the cost of diesel to power generators during load-shedding across its Supermarkets RSA store base for the year amounted to R754 million.

Shoprite spent R500 million in the first half of the year and R254 million in the second half.

“This decrease in diesel costs should be considered in light of a commensurate increase in electricity usage,” the retailer said.

“As a result, we anticipate the percentage increase in the group’s water and electricity expense for the year should be in the mid- to low single digits.”

Shoprite will release its year-end results for the period ended 30 June 2024 on Tuesday, 3 September 2024.

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

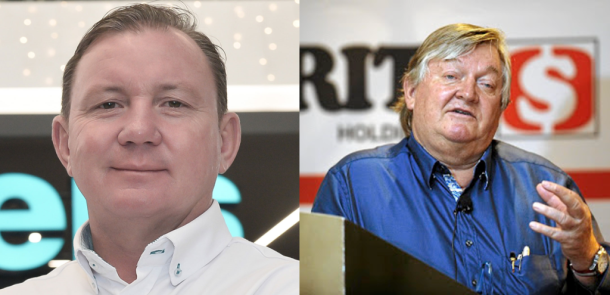

The two men who built Checkers and crushed Pick...

Woolworths expects 19% cut in full-year earnings

Pick n Pay plunges 16% on JSE as stock adjusts ...

SPAR suffering from a hangover