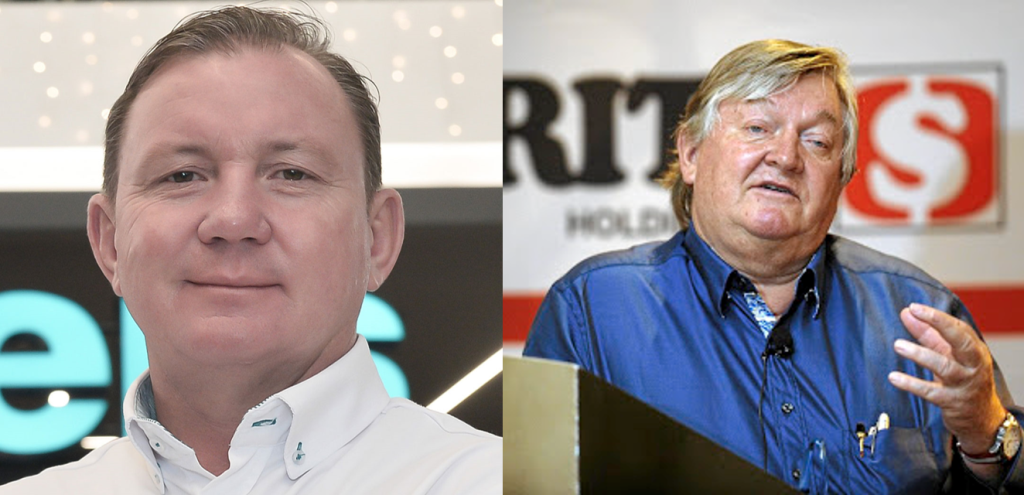

The two men who built Checkers and crushed Pick n Pay

By: Daily Investor

Whitey Basson and Pieter Engelbrecht built South Africa’s most successful retailer and significantly outperformed its main competitor along the way.

On Tuesday, 30 July 2024, Shoprite provided the market with an operational update on its performance over the last financial year.

The retailer increased sales by 12.0% to approximately R240.7 billion. Its core business, Supermarkets RSA, achieved sales growth of 12.3%.

Checkers and Checkers Hyper reported sales growth of 12.3%. Checkers Sixty60’s sales increased by 58.1%.

In South Africa, the Shoprite group opened 201 stores during the year, bringing its total number of stores in the country to 2,322.

Of these net new store openings, 20 were Shoprite, 22 Usave, 25 Checkers, and 71 LiquorShop stores. The remaining 63 were new format, adjacent category specialist stores.

These results came two months after Pick n Pay released its results for the year that ended 25 February 2024. They were disastrous.

Like-for-like revenue only grew by 3%, much lower than inflation, and trading profit fell 87% from R3.05 billion to R385 million.

These factors contributed to Pick n Pay’s R3.2 billion net loss, the worst in the retailer’s 57-year history.

Even more concerning was that Pick n Pay became technically insolvent. To strengthen its balance sheet, it had to raise R4 billion from shareholders in a rights issue.

It is also planning to list Boxer separately on the JSE, with an initial public offering (IPO) set for later in 2024.

Pick n Pay stores as a segment reported an operating loss of R1.5 billion for the 2024 financial year. That is more than a 200% drop from the R1.4 billion profit in 2023.

As a result of this poor performance, Pick n Pay auditors impaired many stores, creating an impairment loss, also known as an asset value write-down, of R2.8 billion.

To fix the problem, 112 of these stores will either be closed or converted to Boxer franchised stores.

The man behind Shoprite and Checkers

Former Shoprite CEO Whitey Basson

It raises the question of why Shoprite and Checkers blossomed over the last fifteen years and why Pick n Pay started to suffer. The answer is management.

James Wellwood “Whitey” Basson turned Shoprite from a small, eight-store grocer into the largest private employer in Africa with over 3,500 stores.

In 1979, Basson reached an agreement with Pep to identify acquisition opportunities or start a new venture in the food retailing business.

Later that year, he acquired a small eight-store Western Cape grocer named Shoprite from the Rogut family.

Basson began restructuring the business and remoulded it in the model of some of the largest European grocery chains at the time, such as Aldi.

Over the next three decades, he rapidly grew the business through acquisitions and turning around struggling businesses.

The acquisitions included six old Ackerman’s food stores, Grand Bazaars, Checkers, and OK Bazaars.

Initially, the name Shoprite Checkers was used. However, in 2001, it started to market the companies separately under the Shoprite and Checkers brands.

The strategic plan was adopted to reposition the Checkers brand as close as possible to its major rival Pick n Pay.

Basson was exceptionally successful and is considered to be one of the best retail chief executives globally.

He grew Shoprite and Checkers from a small eight-store chain to a retailer with a market capitalisation of R150 billion and over 140,000 employees.

On 31 October 2016, Basson, then aged 70, announced that he would be retiring as Shoprite CEO at the end of that year.

He handed the reins to Pieter Engelbrecht, who has been running Shoprite for the last eight years.

Building on Whitey Basson’s legacy

Taking over from a retail giant like Whitey Basson was never going to be easy. However, Pieter Engelbrecht was up to the task.

Under his leadership, Shoprite and Checkers have shown excellent growth and cemented their place as the country’s top food retailers.

Shoprite is achieving industry-leading growth in sales and profits in a trading environment which has presented unprecedented challenges.

Part of his success can be attributed to working under Whitey Basson for two decades. He joined Shoprite Shoprite in April 1997.

Engelbrecht spent ten years leading the retailer’s project office, establishing new brands and building many into multi-billion-rand businesses.

He launched the Money Market financial service counter, USave and LiquorShop and led the acquisitions of Computicket and Transpharm Pharmaceutical Wholesalers.

He was appointed to Shoprite Checkers’s board in 2003, and he served as an Alternate Director of Shoprite Holdings and as its Chief Operating Officer (COO) in 2005.

Engelbrecht strived to drive down costs as COO and played a pivotal role in guiding the retailer’s expansion.

After becoming Shoprite’s chief executive on 1 January 2017, he continued Basson’s great work, which started in 1979.

Apart from being an excellent leader, employing Engelbrecht, a Shoprite stalwart, ensured continuity in the business.

Under his leadership, Checkers has shown excellent growth, overtaking Pick n Pay in revenue for the first time over the last financial year.

A comparison between Checkers and Pick n Pay’s performance over the last two years clearly shows the difference in performance.

Shoprite outperforming Pick n Pay

Whitey Basson and Pieter Engelbrecht’s exceptional performance is best illustrated through a comparison between Shoprite and Pick n Pay.

Since 2002, Shoprite’s revenue increased from R22 billion to R215 billion. Pick n Pay, in comparison, increased from R19 billion to R112 billion.

Shoprite’s net income increased from R397 million to R5.9 billion over the period. Pick n Pay, in comparison, declined from R454 million to a loss of R3.2 billion.

Considering these numbers, it is unsurprising that investors prefer to own Shoprite instead of Pick n Pay.

Shoprite’s share price increased by 3,437% over the last 24 years, while Pick n Pay’s share price increased only by 121% over the same period.

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

Woolworths expects 19% cut in full-year earnings

Checkers-owner is rocking

Pick n Pay plunges 16% on JSE as stock adjusts ...

SPAR suffering from a hangover