Woolworths expects 19% cut in full-year earnings

By Jacqueline Mackenzie – BusinessLive

Woolworths expects to report lower earnings for the full year as challenging trading conditions affected consumer discretionary spend across its businesses,

Group turnover and concession sales from continuing operations for the 53 weeks to end-June grew by 6.2% and by 5.6% on a constant currency basis, it said in a statement on Wednesday.

Headline earnings per share (HEPS) for continuing operations for the comparable 52-week period are expected to be 14%-19% lower in a range of 343c-364.1c. For the total group for the current period — including the contribution of David Jones in the prior period — HEPS are expected to be 27%-32% lower year on year.

The reassessment of the carrying value of the Politix business in Country Road Group resulted in a non-cash impairment of goodwill, which affected the earnings per share (EPS) for continuing operations and the total group, it said.

On a comparable 52-week period to June 23, sales grew by 4.3%, and by 3.2% in the comparable second half of the year, the company said. Online sales grew by 13.3% and contributed 9.2% to group sales for the year.

Turnover and concession sales for the total group — including the contribution of David Jones for the nine-month period in the previous year, and the additional week in the current period -decreased by 16.4% year on year.

The results to be reported for the 53 weeks to end-June are not directly comparable to those of the 52 weeks to June 25 2023. The group disposed of its David Jones operations in Australia during the third quarter of the 2023 financial year and the 2024 reporting period is a 53-week year, which includes a week more than the previous year.

In SA, despite the disruption to business operations caused by load-shedding and congestion at the ports easing in the last quarter, the effect of weak consumer confidence arising from the higher living costs and elevated interest rates weighed on discretionary spend.

Its food business delivered strong and above-market growth, reinforcing its strength and resilience, and the trust that customers placed in the Woolies brand, it said.

Turnover and concession sales grew by 11.2%, and by 9% on a comparable 52-week period. On a comparable store basis, sales grew by 6.9%, notwithstanding the effect of taxi strikes and Avian flu in the first half of the current year.

Price inflation for the period averaged 7.9%.

Underlying trading momentum continued into the second half of the current period, with overall growth of 9.6% further buoyed by the inclusion of the Absolute Pets acquisition in the fourth quarter.

Trading space in Woolworths Food grew by 3.2%, while online sales increased by 52.8%, contributing 5.5% of SA sales driven by increased penetration of its Woolies Dash offering, which delivered a 71.2% increase.

The weak macro environment, poor availability and increased competition from the disruptive entry of international online retailers affected trading in the fashion, beauty and home business.

Net trading space decreased by 0.2%, while online sales grew by 30.4% and contributed 5.6% of SA sales.

The Woolworths Financial Services book decreased by 2.9% on a year-on-year basis.

Retail trading conditions in Australia and New Zealand deteriorated further in the second half, with consumer sentiment at near-record lows and the prolonged cost of living still affecting footfall and discretionary spend. CRG sales declined by 6.8% for the year, by 8% on a comparable 52-week period and 13.1% in comparable stores.

This should be considered in the context of a high prior-period base, in which sales grew by 12% following the strong post-Covid pent up demand in the first half. Sales growth in the second half declined by 11.3%.

Notwithstanding the challenging macroeconomic backdrop, the Country Road brand delivered positive growth for the period, it said.

Woolworths expects to release its annual financial results on September 4.

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

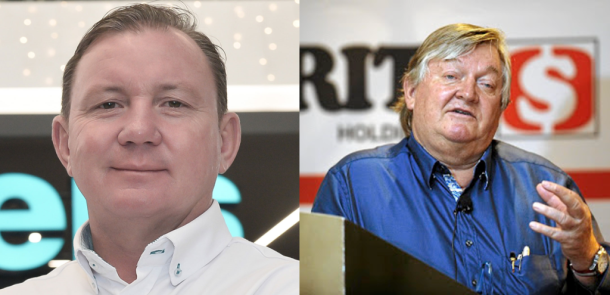

The two men who built Checkers and crushed Pick...

Checkers-owner is rocking

Pick n Pay plunges 16% on JSE as stock adjusts ...

SPAR suffering from a hangover