Pick n Pay expecting a fall in earnings

Pick n Pay is preparing to report a 50 percent fall in earnings for the 26 weeks to August 2020 due to lockdown restrictions, the increased cost as a result of the Covid-19 crisis, and the one-off costs of the voluntary severance programme (VSP), the company said today.

Pick n Pay said, however, the VSP programme which commenced in March was expected to be cost-neutral for the full 2021 financial year, as compensation packages would be fully recouped through cost savings in the second half of the year.

Comparable headline earnings per share for the 26 weeks to 30 August 2020, excluding any impact from hyperinflation accounting in Zimbabwe, would be down more than 50 percent or more than 42.52 cents on the reported 85.03 cents of the previous corresponding period, said the company.

Chief executive Richard Brasher said he was proud of the leadership and dedication showed by everyone in the Pick n Pay and Boxer teams over the past four months.

“Through skill and tenacity, our stores have remained open and safe for staff and customers. This is a tribute to our management teams, store colleagues and franchise partners across the country. By working closely with our suppliers and service providers, our stores have remained stocked with the food and groceries that customers need and want. We have shown innovation, for example re-engineering our digital platforms to meet the large expansion in demand for online and click-and-collect shopping,” said Brasher.

Pick n Pay said while the trajectory and impact of Covid-19 in the coming months remained highly uncertain, the group was hopeful that many of the costs and trading restrictions which have characterised the first half of the financial year would not be repeated.

The group expects to issue a further trading statement in due course.

BUSINESS REPORT

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

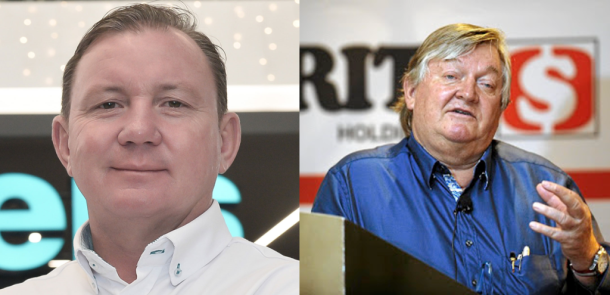

The two men who built Checkers and crushed Pick...

Woolworths expects 19% cut in full-year earnings

Checkers-owner is rocking

Pick n Pay plunges 16% on JSE as stock adjusts ...