Financial pressure on consumers weighs heavily on Pick n Pay performance

Pick n Pay chairman Gareth Ackerman said yesterday that the six months from March to August were among the most difficult South African consumers have had to endure in the recent past.

Speaking at the presentation of the company’s results for the first time after his father and Pick n Pay founder Raymond Ackerman died last month, Ackerman said load shedding reached its worst level since 2008.

He said this had a disproportionately negative impact on the retail industry.

“Food inflation topped 14% in March, its highest level in 14 years, and the price of fuel has risen by about 20% so far this year. Interest rates also reached their highest point since 2009, thanks to 10 successive increases since the end of 2021.

“All of this has proved to be a potent cocktail that has once again put consumers under extreme financial pressure. When I spoke to you a year ago, I referred to several worsening problems in the macroeconomic and socio-economic spheres. Today, I am disappointed that we have seen little or no progress in addressing them,” he said.

Ackerman said South Africa was negotiating one of its most turbulent periods since 1994, and there is significant uncertainty about the country’s future trajectory.

“The performance of Pick n Pay to some extent reflects the difficulties in the economy and society. Even though we are proud of our efforts to support consumers with lower prices and keep internal price inflation well below CPI (for) food, there is no avoiding the conclusion that the group’s result is extremely disappointing,” he said.

There are, however, some encouraging signs and the Pick n Pay story currently is really one of two main operating brands – Boxer and brand Pick n Pay.

Boxer delivered double-digit South African sales growth and is the main growth driver for the group at the moment.

Under the Pick n Pay brand, the same can be said of Pick n Pay Clothing, where sales at standalone stores also grew in double digits, leading the market.

“We have seen superb online sales growth, driven by strong growth in our on-demand platforms, asap! and Pick n Pay groceries on Takealot’s Mr D app. Income from value-added services also grew encouragingly, as the group focused on maximising opportunities in banking services, financial services, and mobile.

“We are encouraged that our businesses in Zambia and Zimbabwe have also performed really well notwithstanding the political issues in Zimbabwe,” he said.

Ackerman said the performance of its core Pick n Pay business, however, had not met expectations.

“The board reflected on the latest performance of the Pick n Pay grocery business and resolved that decisive action was required if we wanted to turn this business around from its current trajectory.

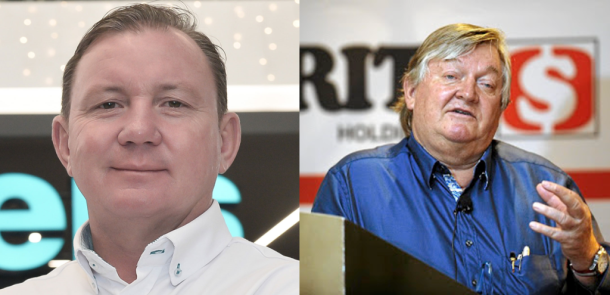

“The board has appointed Sean Summers as CEO to lead the company with immediate effect. Sean understands these basics and how to implement them better than most, and we have confidence in his ability to build back the heart of what Pick n Pay does,” Ackerman said.

He thanked outgoing Pick n Pay CEO Pieter Boone for his dedication.

BUSINESS REPORT

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

The two men who built Checkers and crushed Pick...

Woolworths expects 19% cut in full-year earnings

Checkers-owner is rocking

Pick n Pay plunges 16% on JSE as stock adjusts ...